A basic rule of thumb when attempting to calculate how much mortgage you can afford is to multiply your salary by at least 25 or 3 to obtain an idea of the maximum house price you can afford. How much house can I afford on 100k salary.

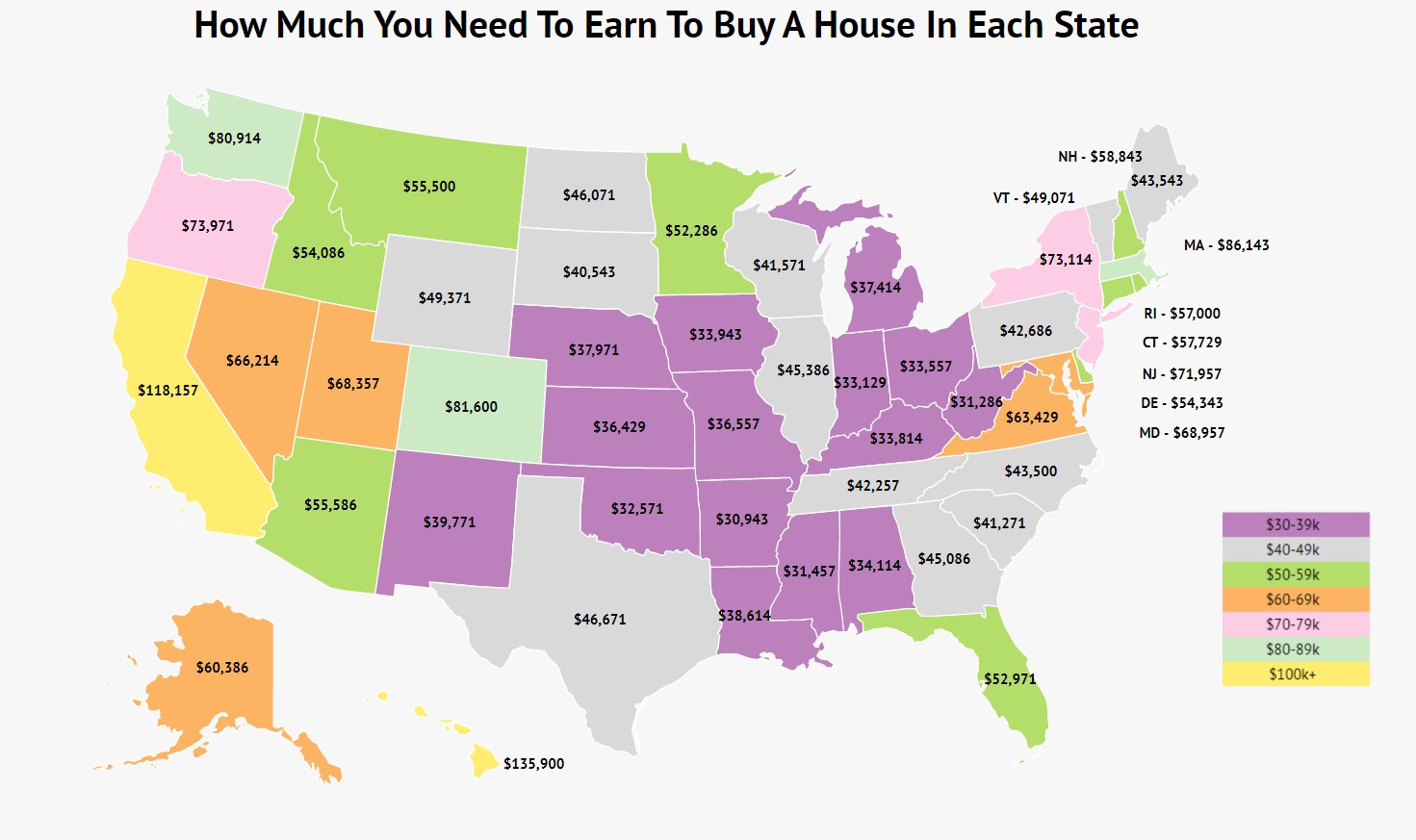

How Much You Need To Earn To Buy A House In Each State Zippia

What is the monthly payment on a 100k mortgage.

. See how much you can borrow Youve estimated your affordability now get pre-qualified by a lender to find out just how much you can borrow. A basic rule of thumb when attempting to calculate how much mortgage you can afford is to multiply your salary by at least 25 or 3 to obtain an idea of the maximum house price you can afford. You should buy a property that wont take anything more than 28 percent of your gross monthly income.

Another rule of thumb is the 30 rule. How much house can I afford. If you earn approximately 100000 the maximum price you would be able to afford would be roughly 300000.

How much can I borrow on 100k salary. If you make around 100000 the utmost price you would be able to pay would be approximately 300000 depending on your situation. Thats because annual salary isnt the only variable that.

When attempting to determine how much mortgage you can afford a general guideline is to multiply your income by at least 25 or 3 to get an idea of the maximum housing price you can afford. If youre wondering how much house you can buy on a 100000 salary the 25 rule will offer you a mortgage of 250000 according to the 25 rule. If you earn approximately 100000 the maximum price you would be able to afford would be roughly 300000.

If you make around 100000 the utmost price you would be able to pay would be approximately 300000 depending on your situation. 1 1000yr for 100K house. This person also has no debts and is prepared to put down 20 on the home.

This number assumes you have very little debt and 112000 in the bank. Assuming a 4 mortgage rate and a 30000 down payment that. A 100k salary is a good salary for an individual.

A 100000 a year salary breaks down to 8333 a month before taxes. How much house can I afford if I make 200K per year. When attempting to determine how much mortgage you can afford a general guideline is to multiply your income by at least 25 or 3 to get an idea of the maximum housing price you can afford.

More realistically 1500 to 2000 per week can get a very nice house or apartment within easy reach of the city or the beaches in any of the countrys major cities including Sydney. For example if you earned 100000 a year it would be no more than 2333 a month. I make 110000 a year.

You can afford a 374000 house. While the average single. What salary do you need to buy a 400k house.

05 500yr for 100K house. If you earn approximately 100000 the maximum price you would be able to afford would be roughly 300000. The most common rule for deciding if you can afford a home is the 28 percent one though many are out there.

If you make around 100000 the utmost price you would be able to pay would be approximately 300000 depending on your situation. 100k income With a 10 deposit contribution worth just over 68000 the maximum affordable property price. Cash in hand for down payment.

Simply take your gross income and multiply it by 25 or 3 to get the maximum value of the home you can affordFor somebody making 100000 a year the maximum purchase price on a new home should be somewhere between 250000 and 300000. And this is a big but. This is what you can afford in 453775 Your monthly payment 2500 Affordable Stretch Aggressive Your debt-to-income ratio DTI would be 36 meaning 36 of your pretax income would go toward.

How Much Are Apartments In Australia. Gross monthly income 8333 Principal and interest payment 1250 Property taxes 250 Property insurance 50 This borrowers total monthly housing cost equals 1550. This means that if you make 100000 a year you should be able to afford 2500 per month in rent.

You can afford a house up to 259819 Based on the information you provided a house at this price should fit comfortably within your budget. 1550 housing expenses 8333 gross monthly income 19 front-end DTI Back-end DTI example. As a rule of thumb a person who makes 50000 a year might be able to afford a house worth anywhere from 180000 to nearly 300000.

Using a 45 percent interest rate and a 30-year term this translates into 1267 monthly which equals 456017 over 30 years. The monthly payment of 1267 is equal to 456017 over the course of 30 years if the interest rate is 45 percent and the period is 30 years respectively. Buying a house with a 100K salary and great credit The third borrower has an excellent credit score of 760.

Simple Mortgage Payment Calculator. If you take 30 of 100000 you will get 30000. Car payments credit cards student loan payment etc.

When attempting to determine how much mortgage you can afford a general guideline is to multiply your income by at least 25 or 3 to get an idea of the maximum housing price you can afford. If you make 70K a year you can likely afford a house payment between 1500 and 2000 a month depending on your personal finances. Is 100k a good salary for a family.

Typical water electricity and gas bills for a house with four bedrooms would cost around 400-500 per month. Only 13 of single female households and 20 of single Male households bring in more than 100k. If you earn approximately 100000 the maximum price you would be able to afford would be roughly 300000.

How much house can I afford 100K salary. If you have a 20 down payment on a 100000 household salary you can probably comfortably afford a 560000 condo. What Can I Do To Lower My Mortgage Payments.

Even for people on. How much house can I afford making 110k a year. A basic rule of thumb when attempting to calculate how much mortgage you can afford is to multiply your salary by at least 25 or 3 to obtain an idea of the maximum house price you can afford.

If youre wondering with 100k salary how much house can I afford the 25 rule gives you a mortgage of 250000. Learn more 1837mo Next. When attempting to determine how much mortgage you can afford a general guideline is to multiply your income by at least 25 or 3 to get an idea of the maximum housing price you can afford.

How Much House Can I Get With 100k Income Youtube

How Much House Can I Afford Bhhs Fox Roach

How Much House Can You Afford On A 100k Salary Youtube

How Much House Can You Afford On A 100k Salary Youtube

How Much Mortgage Can I Afford With A 100k Salary Foundation Mortgage

100k Salary How Much House Can I Afford Mintco Financial

![]()

How Much House Can I Afford Interest Com

How Much Mortgage Can I Afford With A 100k Salary Foundation Mortgage

0 comments

Post a Comment